Places like Latin America and Asia are packed with wonders for travelers. Still, many young adults and graduates worry about taking time off to travel, fearing it might derail their career progress. But here’s the thing: as you age, responsibilities pile up, and opportunities to explore the world become harder to seize. So why not take the chance now to see the world and carve out a path that truly works for you?

What does life have to offer you here?

Australia, like much of the world, has been hit hard by the cost-of-living crisis. Before COVID, a teriyaki footlong at Subway cost about $11.50. Now it’s closer to $14.50. That small jump reflects a much bigger issue—everything is more expensive. A survey by Lisa Heaps found72% of Australians believe wages haven’t kept up with rising prices, and53% said their household finances are worse than two years ago.

For young people, the squeeze is even tighter. Daily choices are dictated by this crisis, from whether to splurge on a decent coffee or settle for an instant shit to deciding if day trip to explore Australia’s natural wonders is worth the hit to your bank account.

Your content goes here. Edit or remove this text inline or in the module Content settings. You can also style every aspect of this content in the module Design settings and even apply custom CSS to this text in the module Advanced

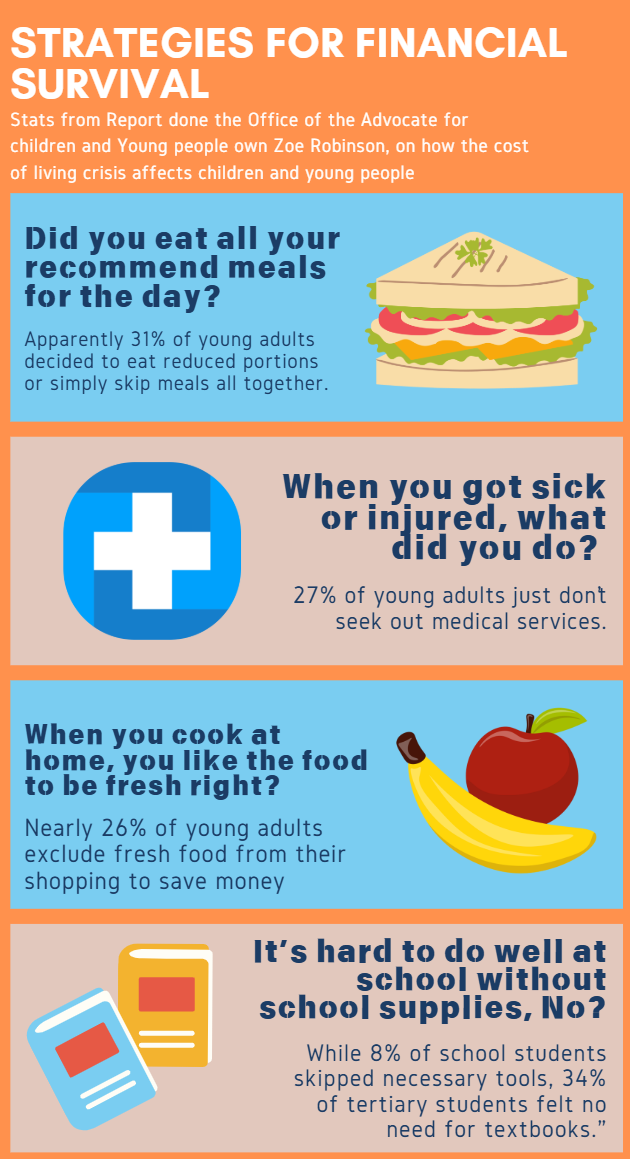

Infographic Stats credit to ACYP’s Zoe Robinson.

Wages are stagnant, stuck at 2011 levels, while housing prices are at 2024 levels. In Sydney, for example, the median dwelling price has skyrocketed from around $540,000 in 2011 to $1,139,375 in 2024. Greg Jerichopointed out that in 2011, the average wage was $52,000, and in 2023, it’s effectively worth just$51,761 in 2011 dollars—$239 less than over a decade ago. For the first time in decades, Australia is experiencing a per capita cost-of-living crisis.

Here’s the kicker: For a lot of young Australians eager to make money to fight back against the raise in prices, finding a job has been an uphill battle.�

�According to the Australian Bureau of Statistics, the unemployment rate in October 2024 sits at4.1%, but for young Australians aged15–24, it’s more than double at9.3%. Add to that an underutilisation rate of10.4% (which includes people seeking more hours) and an underemployment rate of6.3%, and you start to see the problem isn’t just finding work—it’s finding stable, meaningful work that actually covers your bills.

For graduates, the situation isn’t much better. After a brief rebound in 2022 and 2023, graduate opportunities were tracking21% lower in early 2024 compared to the same period the year before, according to Callam Pickering in his analysis of Australia’s shifting recruitment landscape. The job market isn’t just tough—it’s shrinking for us. It’s not just an Australian issue either. When I went home to the states last year, the story from parents of graduates to friends of mine from school was the same—graduates struggling to find their long term job with a degree they worked so hard for.

The more impacted they are now, the more they feel like they don’t have control over their lives. Where we talk about the impact of the cost-of-living crisis on mental health and wellbeing, that comes back and impacts a person’s ability to take part in activities, to do things that will help them succeed in the future. It becomes this vicious cycle that is hard to break.

Dr. Kate Fila said when referring to her youth mental health study through the organization Orygen on how the cost of living crisis is affecting university students and graduates well-being in an article by Gemma Breen for ABC news.

Now, let’s talk about the ultimate dreams—or, at this point, the fantasy of life’s golden goals. Starting a family, getting a nice car and a big one, buying a house. However, the wealth gap is wider than ever, making these goals more and more difficult for young people to work for and achieve.As Peter Davidson highlights, in 2022–23, the average older household (64+) was nearly 4x wealthier than the average younger household (under 35).

Even within younger generations, the divide is massive. Again according to Davidson, the wealthiest 10% of young households saw their wealth soar by 126% over the last two decades. Meanwhile, the bottom 60% barely saw a 39% increase. It’s a system that keeps rewarding the already-wealthy, leaving most of us stuck in a system that’s grinding us down.

As mentioned earlier, house prices continue to rise while wages remain stagnant.Coupled with growing wealth disparity, the opportunities our parents once had now feel like distant dreams, far removed from what was once considered pretty achievable.